Sir Peter Walters, chairman of BP from 1981 till 1990, who has died aged 92, laid the foundations for its transformation right into a premier league worldwide oil firm.

When Walters joined BP in 1954, its administration tradition was nonetheless touched with the imperial flavour of its days because the Anglo-Iranian Oil Firm, and the federal government owned almost half the shares.

He was lucky to reach at a interval of steady progress, and his early postings included two within the US, the place he used the privileged entry to senior administration to make his mark, becoming a member of talks with different oil majors and the US authorities. He was in “the best spot on the proper time”, he mentioned.

He turned managing director in 1973, the time of the primary oil shock. BP reacted by deciding to diversify away from oil, shifting into coal, minerals and knowledge providers, and boosting its current pursuits in diet. However when Walters stepped as much as be chairman in 1981, focus changed diversification, and later he would describe diversification as his greatest mistake. Finally IT, coal and minerals had been all offered. The extra profitable diet division lasted longer, rising nearly to rival the chemical division.

Walters got down to change the tradition from an internalised one, dominated by negotiations between upstream oil-producing and downstream changing companies. As a substitute, he insisted that every should pay its personal manner and that if one other proprietor may do higher, it ought to be offered. His mantra was “no sacred cows”.

Walters’s sturdy free-market beliefs chimed with the fiercer exterior enterprise local weather that impressed the Thatcher authorities and the demand for shareholder worth exemplified by T Boone Pickens’s assault on large oil within the US and James Hanson’s takeovers within the UK. “I made clear to my colleagues that my function was to be a possible predator, to check whether or not they had been getting as a lot worth extraction as one other proprietor.”

By now BP’s core enterprise was in bother. Because the 1982 recession bit, its European refining, chemical substances and delivery enterprise misplaced £600m. Walters acted drastically, calculating that the primary firm to chop again would reap benefit; be much less more likely to be blocked by governments and unions; and have the ability to purchase provides and providers cheaply elsewhere. In three years, 9 of 12 European refineries had been closed, chemical operations had been pruned and BP’s delivery fleet was ultimately handed over to unbiased managers. Managers received used to purchasing in addition to promoting oil.

Earnings from manufacturing successes within the North Sea and Alaska swelled reserves, whereas a rights situation in 1981 introduced in £624m and diluted the federal government’s shareholding to 31.5%. Walters was knighted in 1984. Earnings, which had dipped under £1bn in 1982 and 1983, would rise to greater than £1.7bn by the top of the last decade.

Within the US, the place BP’s subsidiary, Normal Oil of Ohio, had wasted billions of Alaskan revenues on poor exploration choices and diversification into minerals, Walters took decisive motion in 1986, sacking the US administration and putting in as CEO and chief monetary officer two senior Britons, Bob Horton and John Browne. Horton went on to turn out to be chairman of BP, and Browne chief govt. A 12 months later, BP purchased out the US shareholders.

Walters was satisfied that BP may by no means be a top-rank worldwide firm with the federal government as its greatest shareholder; overseas governments, together with the US, would all the time query its independence. Now his want to lower these ties coincided with the Thatcher authorities’s dedication to privatisation. Nigel Lawson, as vitality secretary, then chancellor, was an enthusiastic supporter.

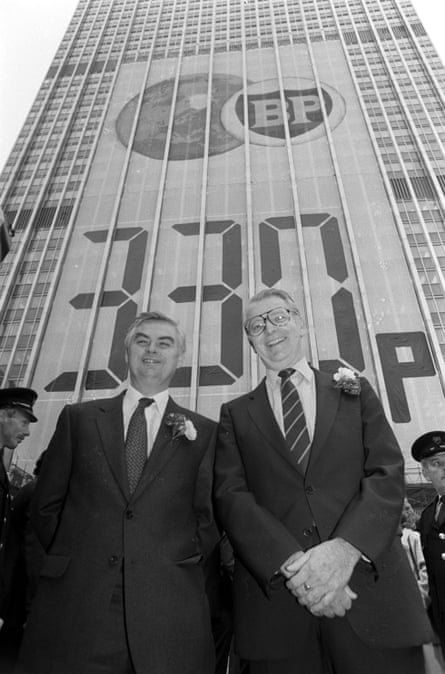

In 1986 postponement of water privatisation had left the federal government with a giant gap in its budgeted funds. It was determined to promote the BP shares, however Walters was horrified to seek out that it was to be an entire sale, not a phased withdrawal. Protests overruled, the sale was launched on 14 October 1987 with the razzmatazz of marines abseiling down BP headquarters. Crucially, Walters, anxious for full independence, refused Lawson’s supply to retain a golden share which might give a veto over any change of possession.

Inside every week, the worldwide inventory market had suffered its Black Monday collapse and the market worth fell under the supply worth. The underwriters wished the difficulty pulled, however Lawson stood agency, anxious to take care of the integrity of the privatisation operation for the longer term. On 28 October, Walters wrote asking for the difficulty to be withdrawn. Lawson determined to proceed, noting, critically, that Walters was “absent and unreachable on the day of choice”.

A brand new disaster erupted. Walters’s letter had warned that with the value so low an unknown purchaser may acquire a majority stake at a really low preliminary price. By 18 November, the Kuwait Funding Workplace had amassed 10% and was nonetheless shopping for. Walters warned Lawson that it may imply a direct competitor demanding a spot on the board, or the US blacklisting BP if a big share was within the arms of an Opec member. Lawson rang Walters to counsel BP contact the KIO chairman direct. “He thanked me however did nothing,” the chancellor reported.

By now one other battle was joined. On 8 December, BP launched a daybreak raid to purchase 15% of Britoil, an earlier privatisation of the federal government’s oil pursuits, and made a suggestion for an extra 14.9%. They had been up towards the US firm Atlantic Richfield (AKA Arco), however Walters gambled accurately that the golden share the in Britoil that the federal government had retained wouldn’t be used to dam consolidation of two British corporations. He was proved proper and Arco offered their 24% to BP.

It was left for the federal government initially to resolve the Kuwaiti situation, referring it to the Monopolies and Mergers Fee on public curiosity grounds. In September 1988 it dominated that the holding operated towards the UK public curiosity and ordered KIO to scale back under 10%. In January, Walters, despite misgivings amongst some monetary advisers, spent valuable BP reserves in shopping for half the KIO shares.

It was a messy finish to a profitable tenure. When he retired a 12 months later, in 1990, he left an organization weaker than it may need been, however genuinely unbiased, with earnings, cashflow and return on fairness aggressive within the trade, and managers snug with the free-market outlook. Though BP stumbled beneath his successor, Horton, its restoration got here beneath the management of key members of his group. Even US commentators noticed Walters as having led the entire trade away from vertical integration to a tradition that emphasised buying and selling and decentralisation.

He was born in Birmingham. His father, Stephen, a policeman, was killed in an air raid throughout the second world struggle and he was introduced up by his mom, Edna (nee Redgate). Cash was tight however Peter received a spot at King Edward’s faculty, Birmingham, after which studied economics at Birmingham College, becoming a member of BP in 1954 after nationwide service with the Royal Military Service Corps.

After leaving BP, Walters took his analytical curiosity in technique and construction, as chairman, first to Blue Circle after which to the Midland Financial institution, now HSBC. In 1994 he turned chairman of the pharmaceutical firm SmithKline Beecham and led it into its merger with Glaxo six years later.

He was a reassuring chairman of the Institute of Administrators (1986-92) and governor of the London Enterprise Faculty for 10 years (1981-91), the final 4 of them as chairman of the governors. In 2002, he returned to the oil trade, becoming a member of the advisory board of the Russian Tyumen Oil Firm with a short to advise on company governance and technique.

Personally, Walters was disarmingly soft-spoken and approachable, nearly insouciant, with a energetic social curiosity offsetting his decided dedication to free-market economics. His longstanding reference to the Police Basis, reflecting his father’s career, culminated in his changing into its president in 2001.

He’s survived by his second spouse, Meryl (nee Marshall), whom he married in 1992, and by two sons, James and Alastair, and a daughter, Caroline, from his first marriage, in 1960, to Patricia Tulloch, which resulted in divorce in 1991.