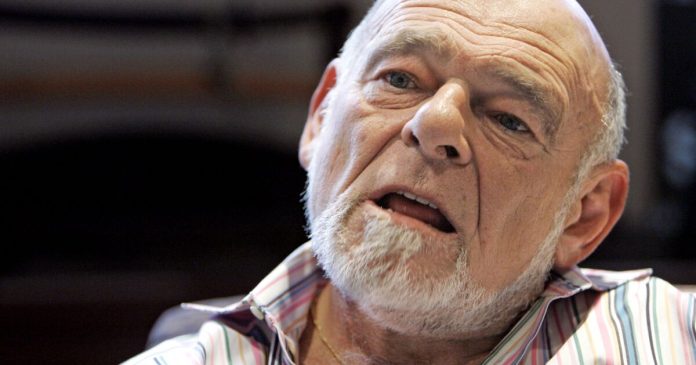

Sam Zell, who made his billions resurrecting troubled companies that ran the gamut from bicycles to actual property, has died at 81.

His loss of life was introduced by Chicago-based Fairness Residential, the actual property firm he based.

The place others noticed purple ink, Zell noticed potential worth, calculated the dangers and plotted a path to revenue.

“You gotta dance across the edge,” the brash, bearded mogul, who delighted in calling himself “the Grave Dancer,” as soon as wrote of his funding philosophy. “However you don’t fall in.”

Then got here what he would later name “the deal from hell.”

In 2007, Zell made nationwide headlines when he acquired Tribune Co., a distressed media conglomerate that owned radio stations and main newspapers, together with the Los Angeles Occasions and the Chicago Tribune. Believing that the newspaper enterprise had a future, he rode in, promising innovation and reinvention.

Lower than 12 months later, nonetheless, Tribune collapsed in what then was the biggest chapter in American media historical past. A brand new wave of turmoil hit the corporate’s venerable papers and brought about 4,000 workers to lose their jobs throughout Tribune’s lengthy slog out of insolvency.

Zell misplaced $315 million — his private stake within the $8.2-billion transaction that made him an unlikely baron of the information enterprise — however he retained his well-known swagger.

“Folks are likely to ask me in regards to the Tribune prefer it was one thing equal to having misplaced a toddler,” Zell, who died Thursday in Chicago on account of issues from a latest sickness, advised Crain’s Chicago Enterprise in 2014. “I promise I by no means had any form of feelings like that.”

Identified for his bluejeans, foul language and love of bikes, the person Forbes as soon as described as “considered one of America’s most inventive dealmakers” strode into the newspaper world throughout a dangerous time for the trade.

The web was laying waste to a enterprise mannequin that had held up for greater than a century, inflicting print readership and advert revenues to nosedive. Tribune, which in 2000 had bought The Occasions and greater than 30 different each day papers and tv stations from Occasions Mirror Co., had been languishing on the public sale block when Zell made a profitable eleventh-hour bid.

The deal hinged on the creation of an worker inventory possession plan, or ESOP, a construction that may enable Tribune to keep away from most federal earnings taxes. The ESOP would borrow the lion’s share of the $8.2-billion buy worth, including enormously to the corporate’s already appreciable debt.

Though Los Angeles billionaires Eli Broad and Ron Burkle expessed curiosity in buying Tribune, Zell, who maintained houses in Chicago and Los Angeles, grew to become Tribune’s chairman and put in a cocky new administration crew to shake up what he noticed as a moribund company tradition.

“The problem is, how will we get someone 126 years outdated to get it up?” Zell advised an auditorium stuffed with Occasions workers shortly after gaining management. “I’m your Viagra, OK?”

Zell had no expertise proudly owning newspapers. However in different industries, significantly actual property, the place his fortune began, he was an undisputed grasp of the turnaround, admired for his uncanny sense of when to purchase and when to promote.

His largest payday got here the identical yr he bid on Tribune. He offered his Fairness Workplace Properties Belief, the nation’s largest workplace constructing landlord, to Blackstone Group for $39 billion simply earlier than the nation spun into recession in 2008. It was then the biggest non-public fairness deal in historical past.

“Folks within the trade need to know what his considering is, they usually have a look at it as they do their very own strategic considering,” Stan Ross, an actual property accounting specialist and former vice chairman of Ernst & Younger who died in 2018, as soon as mentioned of Zell, whom he suggested for years. “He’s a visionary. It doesn’t imply he’s proper each time, however he’s a visionary.”

Zell was entrepreneurial from an early age. He was barely out of grade college when he observed a brand new journal known as Playboy, received his fingers on dozens of copies and offered them to his mates for $3.

“I acknowledged a necessity widespread in all 13-year-old boys, noticed a restriction on provide and I took benefit of it,” Zell advised Forbes in 2013. “Fifty-odd years later I’m nonetheless doing the identical factor.”

He was the son of Bernard and Ruchla Zielonka, who escaped Poland with their daughter Leah simply earlier than the Nazi blitzkrieg in 1939. They fled to Lithuania and crossed Siberia to Japan, the place they managed to seek out passage to the USA.

They finally settled in Seattle, the place Zell was born on Sept. 28, 1941. The household later relocated to Chicago, the place his father shortened the household identify to Zell.

The senior Zell was a businessman who dealt in grain, jewellery and finally actual property. He was demanding and opinionated, and so was his son. In line with Greg Burns within the Chicago Tribune, Sam Zell’s quote within the 1959 Highland Park Excessive College yearbook learn: “I’m not arguing with you. I’m telling you.”

After highschool he went to the College of Michigan, the place he earned a bachelor’s diploma in political science in 1963. Whereas nonetheless an undergraduate, he received a job managing his 15-unit scholar condominium constructing. Teaming up with fraternity brother Robert Lurie, he moved from managing flats to purchasing them. By the point Zell completed regulation college, in 1966, he was overseeing a number of thousand flats and owned a number of buildings. He advised Bloomberg that he practiced regulation for under 4 days earlier than throwing all his weight into enterprise dealings.

Whereas in school, he married the primary of three wives. His survivors embrace his spouse, Helen, three kids and 9 grandchildren.

After regulation college, Zell briefly labored at a blue-chip Chicago regulation agency however discovered the work boring and financially unfulfilling. He opened a solo follow however continued to put money into actual property, snapping up distressed condominium buildings in small secondary markets akin to Toledo, Ohio, and Tampa, Fla. He discovered a mentor and early backer in Hyatt Lodge founder Jay Pritzker, “the neatest man I’ve ever met,” Zell advised Barron’s in 2011, who “had an unbelievable grasp of the artwork of the deal.”

Within the Seventies, Zell and Lurie started to diversify into workplace buildings akin to Chicago’s landmark Discipline constructing, which they purchased for $52 million in 1978 and offered for $94 million in 1981.

In 1976, Zell based Fairness Workplace Properties Belief, the primary actual property funding belief to be traded as a part of the S&P 500. An actual property funding belief permits the general public to purchase and promote shares of economic actual property portfolios the identical approach they put money into different industries, and Zell’s use of it was revolutionary.

Zell “created the general public actual property market,” Richard Inexperienced, Lusk chair in actual property on the USC Sol Worth College of Public Coverage, advised The Occasions in 2020.

For Zell, a superb deal needed to meet three primary standards: The property needed to have excessive revenue potential, an appropriate stage of threat and a construction to attenuate taxes. The latter requirement would land him in authorized scorching water.

Within the Seventies, he led an funding group that needed to amass a $9-million condominium and lodge advanced in Reno. The household that owned the property was reluctant to promote till Zell’s group got here up with a plan to deposit a part of the acquisition worth in an offshore account, thereby lowering the sellers’ tax invoice. That switch led to federal prices that Zell and his companions had conspired to defraud and impede the Inside Income Service.

Zell agreed to cooperate with federal prosecutors in the event that they dropped the costs in opposition to him. On account of his testimony on the 1977 trial, his brother-in-law, Roger Baskes, went to jail for 2 years and Zell went on to construct his fortune.

His drive to become profitable finally led him to diversify his portfolio. “The Grave Dancer” grew to become a profitable company raider, taking up radio stations, trailer parks, barges, wire and cable factories and garbage-fueled energy crops.

One in every of his best-known offers concerned Itel Corp., a rail-car and container leasing agency, which he took over in 1985 after it emerged from chapter with $400 million in tax credit on its books. Zell as chairman methodically bought different firms for Itel to function that might share in its tax credit. He elevated income by means of strikes akin to promoting off a cargo container unit for a $250-million revenue, and Itel’s inventory tripled in worth.

Zell made one other shrewd buy in 1991 when he spent $280 million on bankrupt Carter Hawley Hale Shops Inc., a Los Angeles-based division retailer chain. 4 years later, he offered the still-struggling retail large to Federated Division Shops Inc. for $373 million.

The brief (simply over 5 toes tall), craggy-faced tycoon stormed boardrooms just like the proverbial bull in a china store. At an early Itel Corp. assembly, he reportedly flicked cigarette ash over his chair and grounded the butt into the pristine carpet.

“Zell is a helluva asset supervisor, however he’s a brusque kind of man and never very genteel,” Herbert Kunzel, Itel’s retired chairman, advised the New York Occasions in 1991.

After closing the sale of Fairness Workplace Properties Belief to Blackstone Group, Zell started the negotiations that led to the leveraged buyout of Tribune, whose belongings included 25 TV stations and the Chicago Cubs in addition to 9 each day newspapers. Among the many papers Tribune owned, along with the Los Angeles Occasions and the Chicago Tribune, had been the Baltimore Solar, Newsday, the Orlando Sentinel and the Hartford Courant.

“I’m sick and bored with listening to everybody discuss and commiserate over the top of newspapers,” Zell advised the Wall Avenue Journal in 2007. “They ain’t ended they usually’re not going to finish. I feel they’ve an incredible future.”

After successive waves of funds reducing beneath Tribune, many workers had been hopeful that Zell might cease the bleeding and save the corporate.

“Sam Zell was kind of a rock star when he went round and toured the varied properties,” Ann Marie Lipinski, who stop as editor of the Chicago Tribune lower than a yr after Zell’s takeover, advised the New York Occasions in 2010. “Folks had been residing with uncertainty for therefore lengthy they usually hoped one thing good would come from an proprietor with a confirmed observe document of success in different companies.”

However Zell shortly disabused them of that hope. At a meet-and-greet session with Tribune workers, he spoke about the necessity to shake up the company established order to extend income. He expressed no reverence for conventional journalistic values.

When a photographer on the Orlando Sentinel questioned his dedication to severe information — “We’re not the Pennysaver, we’re a newspaper,” she mentioned — he capped his response with an acerbic “F— you.”

Nor did he attempt to appeal reporters and editors throughout a go to to the Tribune papers’ Washington bureau. “That is the primary unit of the Tribune that I’ve talked to that doesn’t generate any income. So all of you,” he mentioned, “are overhead.”

Probably the most tangible indicators of Zell’s dedication to vary Tribune’s cultural dynamics was put in on the firm’s Chicago headquarters: a multi-legged statue he dubbed the “bureaucratic shuffle.” One other not-so-subtle message was the acronym printed on worker badges: “A.F.D.I.,” which stood for “Truly Friggin’ Doing It.”

Zell selected Randy Michaels as Tribune’s new chief government, a former shock jock who had headed Zell’s Jacor Communications radio group (later offered to Clear Channel Communications). Identified to share Zell’s nonconformist tendencies, he had a aptitude for advertising that pushed the boundaries of excellent style. The previous DJ as soon as used his airtime to fake to puree a dwell frog — the mascot of a rival radio station — in a blender.

Michaels put in former associates from the radio world in high administration, though newspapers made up the majority of Tribune’s enterprise. One in every of his hires was former radio programmer Lee Abrams, who, as Tribune’s new chief innovation officer, flooded workers’ inboxes with long-winded and disjointed emails that had been riddled with typos. One in every of his most memorable missives expressed shock that reporters protecting the Iraq conflict had been truly in Iraq.

The brand new managers moved shortly to disrupt enterprise as typical. Just a few months after taking cost, they wrapped The Occasions in a faux entrance web page that was truly an advert for Disney’s “Alice in Wonderland.” Comparable pages had been later offered to Common and NBC. These choices rankled the paper’s rank-and-file and elicited a proper letter of protest from the Los Angeles County Board of Supervisors, which mentioned the promoting ploys made “a mockery of the newspaper’s mission.”

Throughout Tribune’s papers, circulation and revenues continued to say no at a far quicker tempo than Zell had anticipated. Though he had mentioned he wouldn’t lower employees, jobs and budgets had been slashed throughout the corporate because the financial system started to tank. Belongings had been offered, together with Newsday. Prime editors who resisted the Zell crew’s choices had been compelled out, together with Lipinski on the Chicago Tribune and James O’Shea at The Occasions.

“I had by no means witnessed anybody fairly like Zell who, I’d quickly study, was a type of media executives who voiced extra concern in regards to the first quarter than the First Modification,” O’Shea wrote within the Guardian in December 2008 after Tribune filed for Chapter 11 safety.

The corporate entered chapter proceedings with $7.6 billion in belongings and $12.9 billion in debt, most of which stemmed from the loans made to finish Zell’s buyout. Workers cuts mounted whereas high executives obtained lavish, court-approved bonuses that totaled $57.3 million.

Abrams was terminated in October 2010 after sending a companywide electronic mail with pornographic content material. Michaels resigned about 10 days later, after denying a narrative within the New York Occasions that he had advised a gaggle of Tribune executives to “watch this” as he supplied a Chicago waitress $100 to reveal her breasts.

“They threw out what Tribune had stood for, high quality journalism and an actual model integrity, and in only a yr, pushed it down into mud and chapter,” newspaper analyst Ken Physician mentioned.

Zell’s fortune remained largely intact, thanks partly to a widening portfolio of worldwide investments. However the fall into chapter 11 was a blow to his status as “the Grave Dancer” who by no means stumbled.

In some remarks he appeared extra upset in regards to the unhealthy publicity he obtained than the cash he misplaced.

“The media loves nothing greater than to cowl the media,” he advised Forbes in 2011. “That’s high quality for the media. … I simply don’t have to be the media’s bitch anymore.”

Woo is a former Occasions employees author.